SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e) (2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Under Rule 14a-12 |

LSI Industries Inc. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined) |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of this filing. |

(1) | Amount Previously Paid: |

(2) | Form, Schedule or Registration Statement No.: |

(3) | Filing Party: |

(4) | Date Filed: |

2018 2020Annual Meeting of Shareholders

September 28, 201823, 2020

Dear Shareholders:

We are pleased to invite you to attend our 20182020 Annual Meeting of Shareholders. The meeting will be held on Tuesday, November 6, 2018,10, 2020, at 9:00 a.m. atThis year’s Annual Meeting will be a virtual meeting of shareholders. We believe that hosting a virtual meeting provides expanded access and improved communication between our shareholders and the Company’s headquarters, which is located at 10000 Alliance Road, Cincinnati, Ohio 45242. ShareholdersCompany. Only shareholders of record on September 18, 201814, 2020 may attend and vote at the meeting. The approximate mailing date ofMeeting. You will be able to attend the Proxy StatementAnnual Meeting online, vote your shares electronically, and submit your questions during the accompanying proxy card is September 28, 2018.Annual Meeting by visiting www.virtualshareholdermeeting.com/LYTS2020. You will not be able to attend the Annual Meeting in person.

The enclosed Notice of the Meeting and Proxy Statement provide detailed information about the items of business to be conducted at the Annual Meeting and voting procedures for the Meeting. The Proxy Statement also provides information about our Board candidates, the Board and the Board Committees.

We are sending a Notice of Internet Availability of Proxy Materials to you on or about September 24, 2018.23, 2020. The Notice contains instructions that explain how to access and review the proxy materials and our Annual Report on Form 10-K on the internet. The Company believes that this process allows us to provide our shareholders with the information they need in an efficient and timely manner. The approximate mailing date of the Proxy Statement and the accompanying proxy card also is September 23, 2020.

A complete list of shareholders entitled to vote at the Annual Meeting will be available for examination by any shareholder for any purpose in connection with the Annual Meeting during normal business hours at our principal executive offices for a period of at least 10 days prior to the Annual Meeting.

Even if you own only a few shares, we want your shares to be represented at the meeting. IWe urge you to complete, sign, date and promptly return your proxy card in the enclosed envelope.

Sincerely yours,

/s/ Ronald D. Brown

Ronald D. Brown

Interim Chief Executive Officer

|  |

James A. Clark Chief Executive Officer | Wilfred T. O’Gara Chairman of the Board |

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING TO BE HELD ON NOVEMBER 6, 201810, 2020

The Notice of Meeting and Proxy Statement and the Company’s Annual Report on

Form 10-K areare available at www.edocumentview.com/LYTS investors.lsicorp.com/financials/annual-reports

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS OF

LSI INDUSTRIES INC.

Time:

9:00 a.m., Eastern Standard Time

Date:Tuesday, November 10, 2020

Tuesday, November 6, 2018

Place:

LSI Industries Corporate Headquarters

10000 Alliance Road

Cincinnati, Ohio 45242www.virtualshareholdermeeting.com/LYTS2020

Purpose:

● | Elect as members of the Board of Directors the |

● | Ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for fiscal |

● | Approve on an advisory basis the compensation of the Company’s named executive officers. |

Only shareholders of record on September 18, 201814, 2020 may vote at the meeting. The approximate mailing date of the Proxy Statement and proxy card is September 28, 2018.23, 2020.

Your vote is important. Please complete, sign, date, and promptly return your proxy card in the enclosed envelope.

/s/ Howard E. JaplonThomas A. Caneris

Howard E JaplonThomas A. Caneris

ExecutiveSenior Vice President, Human Resources and General Counsel; Secretary

September 28, 201823, 2020

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING TO BE HELD ON NOVEMBER 10, 2020

The Notice of Meeting and Proxy Statement and the Company’s Annual Report on

Form 10-K are available at investors.lsicorp.com/financials/annual-reports

Table of Contents

Page

INTRODUCTION | 1 |

VOTING AT ANNUAL MEETING | 1 |

General Information | 1 |

2020 ANNUAL MEETING PROPOSALS | 2 |

Proposal 1. Election of Directors | 2 |

Proposal 2. Ratification of Appointment of Independent Registered Public Accounting Firm | 2 |

Proposal 3. Advisory Vote on Executive Compensation | 3 |

Other Matters | 4 |

NOMINEES FOR BOARD OF DIRECTORS | 4 |

| 6 |

| 7 |

EXECUTIVE COMPENSATION | |

8 | |

Compensation Discussion and Analysis | |

8 | |

COMPENSATION COMMITTEE REPORT | 19 |

CEO PAY RATIO DISCLOSURE | 26 |

EQUITY COMPENSATION PLAN INFORMATION | 27 |

CORPORATE GOVERNANCE | 27 |

DIRECTOR COMPENSATION | 29 |

COMMITTEES OF THE BOARD | |

30 | |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 33 |

RELATED PERSON TRANSACTIONS | 33 |

OTHER MATTERS | 34 |

QUESTIONS | 34 |

ANNEX A—NON-GAAP MEASURES | |

A-i |

The Company makes available, free of charge on its website, all of its filings that are made electronically with the Securities and Exchange Commission (“SEC”), including Forms 10-K, 10-Q, and 8-K and any amendments thereto. To access these filings, go to the Company’s website (www.lsi-industries.com) and click on the “SEC Filings” tab in the left margin on the “Investor Relations”s” page. Copies of the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2018,2020, including financial statements and schedules thereto, filed with the SEC are also available without charge to shareholders upon written request addressed to:

LSI Industries Inc.

Howard E. JaplonThomas A. Caneris

EVP,SVP Human Resources and General Counsel and Secretary

10000 Alliance Road

Cincinnati, Ohio 45242

LSI INDUSTRIES INC.

10000 Alliance Road

Cincinnati, Ohio 45242

(513) 793-3200

P R O X Y S T A T E M E N T

Annual Meeting of Shareholders

November 6, 201810, 2020

INTRODUCTION

The Board of Directors of LSI Industries Inc. is requesting your proxy for the Annual Meeting of Shareholders on November 6, 2018,10, 2020, and at any postponement or adjournment of such meeting. This Proxy Statement and the accompanying proxy card were first mailed on or about September 28, 201823, 2020 to shareholders of record as of September 18, 2018.14, 2020.

VOTING AT ANNUAL MEETING

General Information

In order to carry on the business of the meeting, we must have a quorum. This means at least a majority of the outstanding shares eligible to vote must be represented at the meeting either by proxy or in person.virtually. Shareholders may vote in personby proxy or by proxyattend the Annual Meeting virtually and vote through the internet at the Annual Meeting. Proxies given may be revoked at any time by filing with the Company (to the attention of Office of the Secretary) either a written revocation or a duly executed proxy bearing a later date, or by appearing virtually at the Annual Meeting and voting in person.through the internet. If you hold shares through someone else, such as a stockbroker or bank, you may get material from them asking how you want to vote. Specifically, if your shares are held in the name of your stockbroker or bank and you wish to vote in personvirtually at the meeting through the internet, you should request your stockbroker or bank to issue you a proxy covering your shares. If you have instructed a broker to vote your shares, you must follow directions received from your broker to change your vote. The Company will bear the entire cost of soliciting proxies from our shareholders.

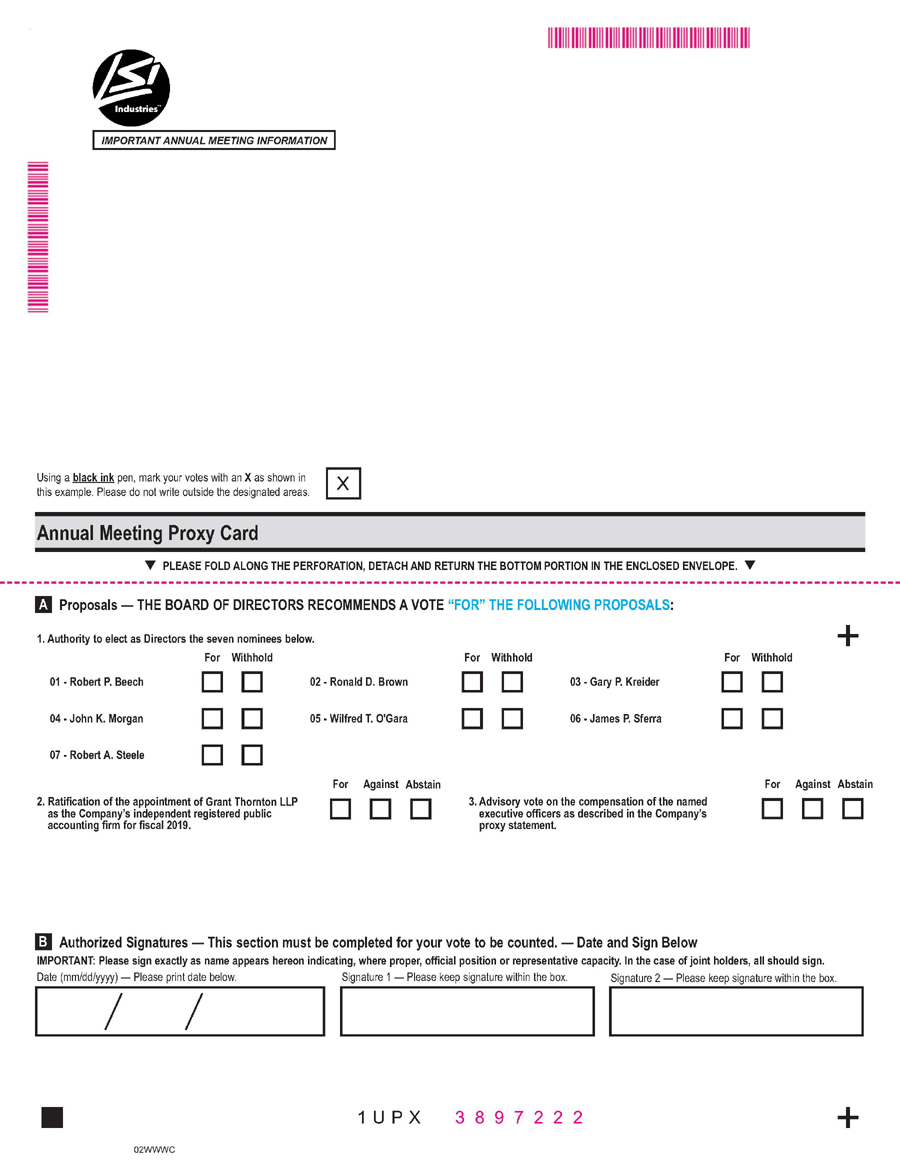

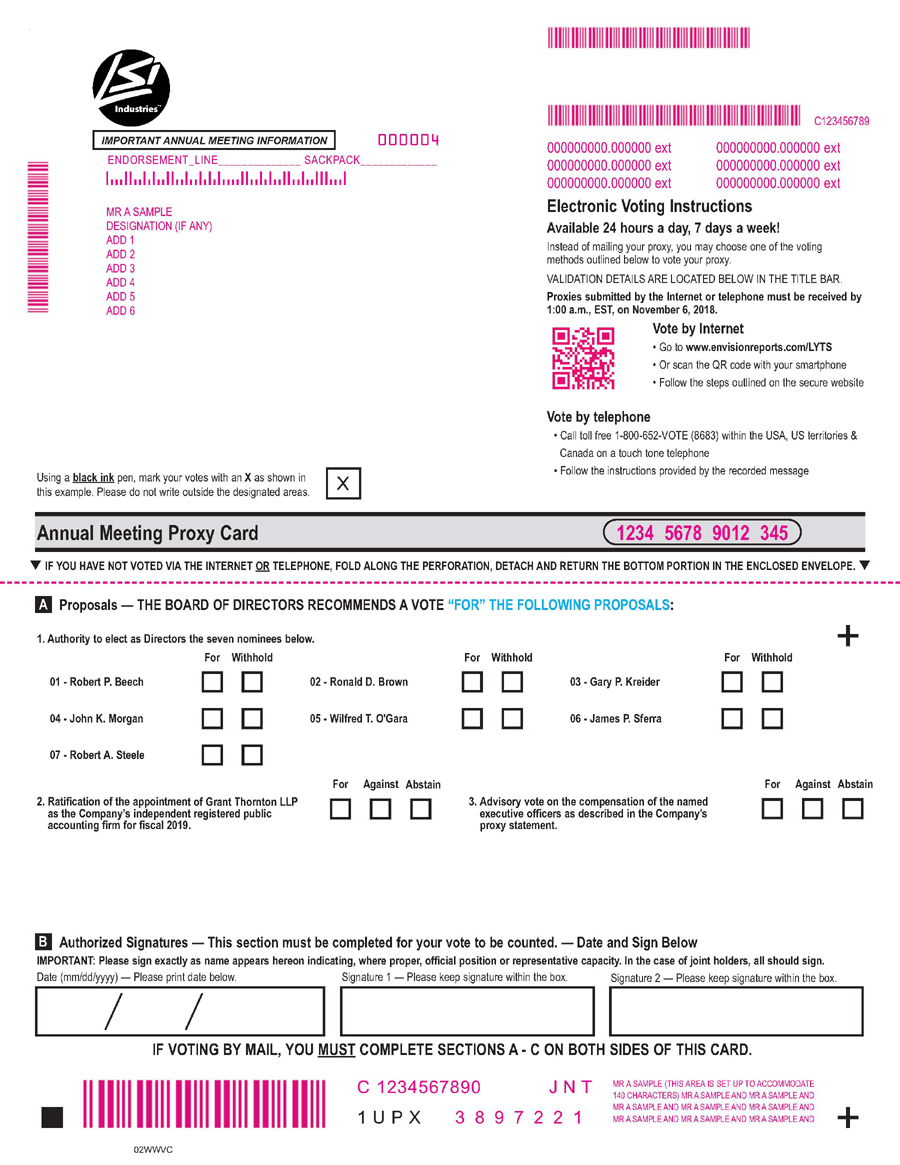

All shares will be voted as specified on each properly executed proxy card. If no choice is specified, the shares will be voted as recommended by the Board of Directors: FOR Proposal 1 to elect as members of the Board of Directors the sevensix nominees named in this Proxy Statement; FOR Proposal 2 to ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for fiscal 2019;2021; and FOR Proposal 3 to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers.

If any other matters come before the meeting or any postponement or adjournment thereof, each proxy will be voted in the discretion of the individuals named as proxies on the proxy card. With respect to Proposal1, the sevensix nominees receiving the greatest number of votes will be elected. Proposal 2 forFOR the ratification of appointment of the Company’s Independent Registered Public Accounting Firm will be adopted only if it receives approval by a majority of the Common Shares voting, virtually or by proxy, at the Annual Meeting. Since Proposal 3FOR the approval of the compensation of the Company’s named executive officers requires by the affirmative vote of at least a majority of the Common Shares present, virtually or by proxy, at the Annual Meeting. Because Proposal 3 on executive compensation is an advisory vote, the Board of Directors will give due consideration to the result of the vote; however, the result of the vote will not be binding on the Company.

Banks or brokers holding shares for beneficial owners must vote those shares as instructed. If the bank or broker has not received instructions from you, as the beneficial owner, the bank or broker generally has discretionary voting power only with respect to the ratification of appointment of the independent registered public accountants. A bank or broker does not have discretion to cast votes with respect to the election of Directors unless it has received voting instructions from you as the beneficial owner of the shares. It is therefore important that you provide instructions to your bank or broker if your shares are held by such a bank or broker so that your vote with respect to Directors is counted.

As of September 18, 2018,14, 2020, the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting, the Company had 25,998,403 26,340,512Common Shares outstanding. Each share is entitled to one vote. Only shareholders of record at the close of business on September 18, 2018,14, 2020, will be entitled to vote at the Annual Meeting. Abstentions and shares otherwise not voted for any reason, including broker non-votes, will be considered as present at the meeting for the purpose of determining the presence of a quorum and have no effect on the outcome of any vote taken at the Annual Meeting, except as otherwise described herein. Broker non-votes occur when a broker returns a proxy card but does not have authority to vote on a particular proposal.

Shareholder Proposals

Shareholders who desire to have proposals included in the Notice for the 20192021 Annual Meeting of Shareholders must submit their proposals to the Company at its offices on or before May 27, 2019.28, 2021.

The form of proxy for the Annual Meeting of Shareholders grants authority to the persons designated therein as proxies to vote in their discretion on any matters that come before the meeting, or any adjournment or postponement thereof, except those set forth in the Company’s Proxy Statement and except for matters as to which adequate notice is received. In order for a notice to be deemed adequate for the 20192021 Annual Shareholders’ Meeting, it must be received prior to August 9, 2019.11, 2021. If there is a change in the anticipated date of next year’s annual meeting or if these deadlines change by more than thirty days, the Company will notify shareholders of this change through its SEC filings.

20182020 ANNUAL MEETING PROPOSALS

Proposal 1. Election of Directors

The Nominating and Corporate Governance Committee of the Board has nominated for re-election the six current members of the Board of Directors: Robert P. Beech, Gary P. Kreider,Ronald D. Brown, James A. Clark, Amy L. Hanson, Chantel E. Lenard and Wilfred T. O'Gara. As we reported in our Form 8-K on June 19, 2020, John K. Morgan Wilfred T. O'Gara, James P. Sferra, and Robert A. Steele. It has also nominated for election one new candidate, Ronald D. Brown. Proxies solicited byinformed the Board willthat he would not be votedstanding for re-election at the election of these seven nominees.Annual Meeting. Please see the “Nominees for Board of Directors” section of this Proxy Statement for additional information about each nominee.

All individuals elected at the 20182020 Annual Meeting will hold office for a one yearone-year term expiring at the 20192021 Annual Meeting and until their successors are elected and qualified or until their earlier resignation, retirement or removal. Shareholders are entitled to one vote for each share held of record. Proxies solicited by the Board will be voted FOR the election of these six nominees. Shareholders are not entitled to cumulate their votes in the election of members of the Board of Directors. If any of the nominees become unable to serve, proxies will be voted for any substitute nominee designated by the Board.

The Board of Directors recommends a vote FOR each of the sevensix individuals nominated in this Proxy Statement. The sevensix nominees receiving the greatest number of votes will be elected.

Proposal 2. Ratification of Appointment of Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has appointed Grant Thornton LLP as the Company’s independent registered public accounting firm for fiscal 2019.2021. Grant Thornton has been the independent registered public accounting firm for the Company since September 8, 2009 and had also previously served the Company in this capacity from April 2002 to December 2005. Although not required by law, the Board is seeking shareholder ratification of its appointment of Grant Thornton. If ratification of the appointment is not obtained, the Audit Committee intends to continue the employment of Grant Thornton at least through fiscal 2019.2021.

Representatives of Grant Thornton are expected to be present at the Annual Meeting and will be given an opportunity to make a statement, if they so desire, and to respond to appropriate.appropriate questions. The aggregate fees billed to the Company by Grant Thornton for the fiscal years ended June 30, 20172019 and 20182020 were as follows:

| Fee Category | 2017 | 2018 | 2019 | 2020 | ||||||||||||

Audit Fees | $ | 879,500 | $ | 798,000 | $ | 826,900 | $ | 771,900 | ||||||||

Audit-related Fees | 101,225 | 29,300 | $ | 39,300 | $ | 16,000 | ||||||||||

Tax Fees | 61,050 | 140,953 | $ | 88,750 | $ | 168,328 | ||||||||||

All Other Fees | 4,900 | 4,900 | $ | 4,900 | $ | 0 | ||||||||||

Total Fees | $ | 1,046,675 | $ | 973,153 | $ | 959,850 | $ | 956,228 | ||||||||

Audit fees represent fees and out-of-pocket expenses related to the audit of the Company’s financial statements; review, documentation and testing of the Company's system of internal controls; filing of the Form 10-K; services related to review of the Company’s quarterly financial statements and Form 10-Q’s; and attendance at the Company’s quarterly Audit Committee meetings. Audit-related fees represent fees for consultation related to accounting and regulatory filing matters, acquisition due diligence services, and tofor audits of the Company’s qualified retirement plan. Tax fees represent fees for services and out-of-pocket expenses related to tax compliance (or filing of the Company’s various income and franchise tax returns), tax planning, and tax advice. All other fees represent fees related to services and consultation on various planning matters.

Please see the “Committees of the Board” section of this Proxy Statement for additional information about the Audit Committee.

The Board of Directors recommends a vote FOR this proposal. The affirmative vote of a majority of Common Shares voting at the Annual Meeting is required to approve this proposal.

Proposal 3. Advisory Vote on Executive Compensation

The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010, provides the Company’s shareholders the opportunity at the Annual Meeting to vote on an advisory resolution on the compensation of the Company’s named executive officers. This advisory vote is commonly known as “Say-on-Pay”. Please see the “Executive Compensation” section of this Proxy Statement for additional information regarding the Compensation Committee and fiscal 20182020 executive compensation. Since the vote is advisory, it will not be binding on the Compensation Committee or the Board of Directors; however, the Compensation Committee and the Board of Directors will take the results of the vote into account when reviewing the Company’s executive compensation plan and programs.

The Compensation Committee is committed to maintaining executive compensation plans and programs that enable the Company to attract and retain a superior management team with incentives targeted to build long-term shareholder value. The Company’s compensation plans and programs utilize a mix of base salary, short-term annual cash incentive awards and long-term equity-based incentive awards to align executive compensation with the Company’s annual and long-term performance. These plans and programs reflect the Committee’s philosophy that executive compensation should provide greater rewards for superior performance, as well as accountability for underperformance. At the same time, the Committee believes the Company’s executive compensation plans and programs do not encourage excessive risk-taking by management. The Board of Directors believes that this philosophy and practice have resulted in executive compensation decisions that are appropriate and that have benefited the Company over time.

For these reasons, the Board of Directors requests that shareholders approve the compensation of the Company’s named executive officers as described in this Proxy Statement pursuant to SEC disclosure rules, including the Compensation Discussion and Analysis, the executive compensation tables and the related footnotes and narratives accompanying the tables.

The Board of Directors recommends a vote FOR this proposal. The Board of Directors will give due consideration to the result of this non-binding advisory vote.

Other Matters

The affirmative vote of a majority of Common Shares entitled to votepresent virtually or by proxy at the meeting is required to approve any other matters considered at the Annual Meeting, including postponement or adjournment.

NOMINEES FOR BOARD OF DIRECTORS

The following individuals have been nominated for election by the Board of Directors as recommended by the Nominating and Corporate Governance Committee. Each nominee is currently a member of the Board of Directors, other than Mr. Brown, who joined the Company as its Interim Chief Executive Officer on April 23, 2018.Directors.

The Board of Directors recommends a vote FOR each of the sevensix nominees. The sevensix nominees receiving the greatest number of votes will be elected.

Robert P. Beech (age 65)67) has been a Director since July 2013. Mr. Beech is currently the President of PentaBeech, LLC, a privately held strategy and innovation advisory firm. Mr. Beech was formerly the Executive Chairman of Eccrine Systems, Inc., a privately held Cincinnati-based biotechnology company that he co-founded in 2013. Mr. Beech has been engaged as Entrepreneur-in-Residence for bioscienceslife sciences at CincyTechUSA since 2013. From 2004 through 2012 he was a senior executive at Precigen, Inc. (formerly Intrexon Corporation,Corporation), when it was a privately held biotechnology company based in Maryland. Prior to 2003, he was Chief Executive Officer of Digineer, Inc., an international healthcare IT software and services company he founded in 1986 and led until 2002. The Board believes that Mr. Beech’s substantial experience leading high-technology ventures as a CEO or senior corporate executive qualify him to serve on the Board. He serves as ChairmanChair of the Company’s Nominating and Corporate Governance Committee and asis a member of the Audit Committee and the Compensation Committee.

Ronald D. Brown (age 65)67) has been a Director since November 6, 2018. He served as Interim Chief Executive Officer of the Company sincefrom April 23, 2018 to November 1, 2018. Prior thereto, Mr. Brown currently serves as Interim President & CEO of Cincinnati Incorporated since July of 2020. Cincinnati Incorporated is a privately owned machine tool company. He served from March 2017 to April 2018 as Vice Chairman of The Armor Group, Inc. which he joined in 2013 as chief operating officer. The Armor Group, Inc. is a certified woman-owned corporation that manufactures equipment and products and provides related services to a variety of industrial markets. From 2009 until 2014, Mr. Brown was managing director of Taft Business Consulting, LLC, a consulting group affiliated with the law firm of Taft Stettinius & Hollister LLP, which provides advisory services on a range of business issues. Prior to that, Mr. Brown was Chairman and Chief Executive Officer of Milacron Inc. (NYSE) from 2001 to 2008 and President and Chief Operating Officer of Milacron Inc. from 1999 through 2001. Milacron is a supplier of plastic processing and metalworking fluid technologies. Mr. Brown has served as a director of A. O. Smith Corporation (NYSE) since 2001 and is the chairperson of its Personnel and Compensation Committee and a member of its Nominating and Governance Committee. A. O. Smith manufactures and markets comprehensive lines of water heaters and water treatment products. Mr. Brown also served as a director of Zep Inc. (NYSE), where he was chairman of the Compensation Committee and a member of the Nominating and Corporate Governance Committee, until it was acquired by New Mountain Capital in 2015. He also joined the James Advantage Funds Trust in 2014 as an independent trustee and serves on its Audit Committee.and Governance and Compensation Committees. The Board believes that Mr. Brown’s experience as the chief executive officer and chairman of a publicly held company provides valuable insight as to the issues and opportunities facing the Company. Further, he has international and manufacturing experience with The Armor Group and in his previous positionpositions at Milacron. In addition, Mr. Brown has experience as a chief financial officer and a corporate attorney. The Board also believes that his legal background makes him well-suited to address legal and governance requirements of the SEC and NASDAQ. Mr. Brown serves on the Company’s Executive and Compensation Committees.

Gary P. Kreider James A. Clark(age 80) (age 56) has been Chief Executive Officer since November 2018 and a Director since April 2002 andJanuary 2019. Mr. Clark previously served as the Company’s Chairman from November 2014 to August 2018.President and CEO at Alliance Tire Americas, Inc. (a KKR portfolio company) and as Managing Director at Dunes Point Capital. Mr. Kreider wasClark has over 25 years of experience as a senior partneroperating executive in the Cincinnati law firm of Keating Muething & Klekamp PLL, the Company’s outside counsel. He joined Keating Muething & Klekamp PLL in 1963global manufacturing and is now retired from the firm. His primary practice areas were securities law, mergers and acquisitions, and general corporate law. Effective October 2005 Mr. Kreider no longer had a vote or partnership interest in the firm’s earnings although his affiliation with the firm continues. Mr. Kreider’s present activities consist of personal investing, serving as trustee of various trusts and as a director of the Company. He has alsoproduct services companies. Prior to joining Dunes Point Capital, he served as an adjunct professorVice President of lawStrategy and Corporate Development at Rexel Holdings USA, where he was responsible for the strategic planning and M&A activities for REXEL’s $3.5 billion of revenues in securities regulationsU.S. operations. Prior to joining REXEL, Mr. Clark served in several senior executive positions with United Technologies Corporation (UTC) and General Electric (GE), including President of Electronic Security Products Group and CMO- VP of Global Sales for GE Security. He holds a BA in Business from The State University of New York – Regents and participated in postgraduate study programs at Northwestern University - Kellogg School of Business and the University of Cincinnati, CollegeVirginia - Darden School of Law and is a past chairman of the Ohio State Bar Association Corporation Law Committee.Business. The Board believes that Mr. Kreider’s legalClark's substantial management and operating experience, as a prominent corporate and securities practitioner andwell as his corporate and public-company board experience makeposition as our Chief Executive Officer, qualify him well qualified to serve on the Board, which must deal with the myriad issues presented by virtueBoard. Mr. Clark is a member of the Company being publicly-traded.Company’s Executive Committee.

John K. MorganAmy L. Hanson (age 64)62) has been a Director of the Company since January 2019. Ms. Hanson is currently the CEO of Amy Hanson Advisory Services, a retail management strategic services consulting firm, since April 2016. Mr. Morgan wasMs. Hanson also serves on the Chairman, Presidentboards of Messer, Inc (one of the of the Midwest’s largest construction companies) and Chief Executive Officer of Zep(Strivve, Inc. (NYSE)(formerly Switch Inc.), a specialty chemicals company, from October 2007 until his retirement in June 2015. From July 2007Seattle based fin-tech start up. Prior to October 2007, he served as Executive Vice President of Acuity Brands and President and Chief Executive Officer of Acuity Specialty Products, just prior to its spin-off from Acuity Brands, Inc. From 2005 to July 2007, he served as President and Chief Executive Officer of Acuity Brands Lighting. He also served Acuity Brands as President and Chief Development Officer from 2004 to 2005, as Seniorthat she was an Executive Vice President and Chief OperatingCorporate Officer from 2002 to 2004,for Macy’s Inc, a leading department store retailer with over 680 stores throughout the US for over 30 years. Ms. Hanson had responsibilities for leading financial, credit and customer services for Macy’s. During her career at Macy’s, she also had direct responsibilities for procurement, real estate, store planning, design and construction as Executivewell as serving as Vice President from 2001 to 2002. Mr. Morgan has served as a director of Wesco International, Inc. (NYSE), a provider of electrical, industrial, and communications MRO and OEM products, construction materials, and advanced supply chain management and logistics services, since 2008 and is currently the chairman of Wesco's Compensation Committee.Chairman for Macy’s North. The Board believes that Mr. Morgan’sMs. Hanson’s insight and experience with corporate governance, executive compensation, businessin finance, strategic planning, and operating management issues, gainedleadership through experience at various levelstimes of corporate managementchange, acquisitions and on boards, and his status as an independent director,mergers for Macy’s qualify himher to serve on the Board, as well as chair the ChairmanAudit Committee, and as a member of the Compensation and Nominating and Corporate Governance Committees.

Chantel E. Lenard(age 51) has been a Director of the Company since June 17, 2020. Ms. Lenard presently serves as a Lecturer of Marketing in the MBA program at the University of Michigan Ross School of Business. Ms. Lenard retired from Ford Motor Company (NYSE: F) in 2017, having served as the top marketing executive for Ford in both the U.S. and Asia. From 2013 to 2017, Ms. Lenard held the position of U.S. Chief Marketing Officer, leading the organization’s pricing, promotions, media, digital marketing, product strategy, and consumer experience activities. From 2010 to 2013, Ms. Lenard was based in Shanghai, China, as Vice President of Marketing for Ford’s Asia Pacific and Africa operations, where she led the marketing activities for 11 countries across the region. In addition to her marketing roles, Ms. Lenard held a number of leadership positions in strategy, sales, finance, and purchasing during her 25-year career with Ford. Ms. Lenard has served as a member of the Board of Directors of TTM Technologies Inc. (Nasdaq: TTMI) since November 2018 and Uni-Select Inc. (TSX: UNS) since May 2020. The Board believes that Ms. Lenard’s substantial marketing and management experience, particularly her leadership positions in strategy, sales, finance, and purchasing, qualify her to serve on the Board as well as on the Audit Committee and Compensation Committee.

Wilfred T. O'Gara (age 61)63) has been a Director since January 1999 and was appointed Chairman in August 2018.2019. Mr. O’Gara is the Managing Director of Buffalo Fork Holdings, LLC, an investment company. He previously served as Chief Executive Officer of Isoclima SpA from July 2017 to August 2018.2019. Isoclima SpA produces transparent armor and other specialized glass and polycarbonate products for military and civilian armored vehicles. Prior to joining Isoclima, Mr. O'Gara served as Vice Chairman of The O’Gara Group, a security and defense related firm, from 2016 until July 2017 and he was the President and Chief Executive Officer from 2003 to 2017. Mr. O’Gara has been identified as an “audit committee financial expert” under SEC guidelines given his understanding of accounting and financial reporting, disclosures and controls. The Board believes that Mr. O’Gara’s independence from management, experience as a successful principal executive and his designation as an audit committee financial expert make his service integral to the Board. He serves as Chairman of the Audit Committee and as a member of the Compensation Committee and the Nominating and Corporate Governance Committee.

James P. Sferra (age 79) shared in the formation of the Company and has been a Director since 1976. Mr. Sferra served as Corporate Vice President of Manufacturing from November 1989 to November 1992, and as Executive Vice President-Manufacturing from November 1992 to March 2015. Prior to that, he served as Vice President-Manufacturing of LSI Lighting Systems, a division of the Company. In 1996 he was appointed Secretary of the Company and served in that capacity until March 2015. The Board believes that Mr. Sferra is uniquely qualified to serve on the Board given his long-standing tenure with the Company and his familiarity with the integral manufacturing component of its operations.

Robert A. Steele (age 63) has been a Director since July 2016. Mr. Steele retired from Procter & Gamble in 2011 as its Vice Chairman Health Care. During his 35-year tenure with Procter & Gamble, he served in a variety of executive leadership positions, including Vice Chairman Global Health and Well-being, Group President Global Household Care, and Group President of North American Operations. Mr. Steele has served on the board of Berry Global Inc. (NYSE) since 2014 and as a member of its Nominating & Corporate Governance Committee. He has served on the board of BJ’s Wholesale Club, Inc. (NYSE) since 2016 and is a member of its Audit Committee and its Compensation Committee. Mr. Steele also joined the board of Newell Brands Inc. (NYSE) in April 2018 and serves as a member of its Finance Committee. Mr. Steele was previously a member of the Board of Directors of Beam Inc., Keurig Green Mountain and Kellogg Company. The Board believes that Mr. Steele’s insight and experience with corporate governance, leadership and operating experience in a public company, and his status as an independent director qualify him to serve on the Board of Directors. He serves as a member of the AuditCompany’s Executive Committee and the Nominating and Corporate Governance Committee.

Board Qualifications and Succession Planning

The Nominating and Corporate Governance Committee periodically reviews the skills, experience and characteristics required of Board members in the context of the current make-up of the Board and screens and recommends nominees for director to the full Board. Its assessment includes the skills of Board candidates, such as an understanding of technologies pertinent to the Company’s businesses, manufacturing, marketing, finance, regulation and public policy, experience, age, diversity and ability to provide strategic insight and direction on the Company’s key strategic initiatives. In addition to skills and experience, Board candidates are considered based upon various criteria, such as their personal integrity and judgment, business and social perspective, and concern for the long-term interests of the Company’s shareholders. After receiving recommendations for nominations from the Committee, the Board nominates candidates for Director. The Committee, or other members of the Board of Directors, may identify a need to add new members to the Board of Directors with specific skills or to fill a vacancy on the Board. At that time, the Committee would initiate a search, seeking input from Board members and senior management and, to the extent it deems appropriate, engaging a search firm. An initial qualified candidate or a slate of qualified candidates wouldmay be identified through this process and presented to the Committee for its evaluation and approval. The Committee would then seek full Board approval of the selected candidate.

DIRECTOR WITH EXPIRING TERM

Dennis W. Wells served as the Company’s Chief Executive Officer from October 2014 until April 23, 2018. Effective April 23, 2018, the Board of Directors notified Mr. Wells of the termination of his employment. The Board appointed Ronald D. Brown as Interim Chief Executive Officer at that time to replace Mr. Wells. Mr. Wells has remained a member of the Company’s Board of Directors following such date. He was not nominated by the Nominating and Corporate Governance Committee for re-election at the 2018 Annual Meeting. His term as a member of the Board will expire at the 2018 Annual Meeting.

EXECUTIVE OFFICERS

Ronald D. Brown (age 65) has served as Interim Chief Executive Officer of the Company since April 23, 2018. Mr. Brown has been nominated for election toThe following are the Company’s Board of Directors at the 2018 Annual Meeting. Please see thecurrent executive officers (not including our CEO, James A. Clark, whose biographical information is set forth above under “Nominees for Board of Directors”) and the named executive officers as identified in the compensation tables in the Compensation Discussion and Analysis section for a more complete summary of his career and experience.this proxy statement.

Jeff A. CroskeyJeffery S. (age 46)Bastian(age 60) has been Vice President and Chief Accounting Officer since June 2017, and prior to that he was the Company’s Vice President and Controller since 2004. He has served as Chief Commercial Officer of the Company since August 15, 2018.for thirty years in various finance and accounting roles. Prior to LSI, he was with Touche Ross and Company from 1986 to 1989. He joined the Company asgraduated from Eastern Kentucky University with a BS degree in Environmental Sciences and obtained an MBA from Wright State University.

Michael C. Beck (age 63) has been Senior Vice President of the Graphics segment in October 2015. Prior thereto heOperations since February 2019. Mr. Beck served as Vice President, North Region for Simpler Consulting, an IBM Company, from 2014 through January 2019. Previous roles included VP Quality and General ManagerOperational Excellence for the Otis Elevator and UTC Fire & Security Divisions of Creative Sign Designs from February 2010 to October 2015. His previous executive leadership roles include Chief Operating Officer of Imagine International Inc.,United Technologies Corporation, and Vice President Manufacturing for the Construction Division of Operations for McNichols Company, and numerous roles for Crestline Homes and The Goodyear Tire & Rubber Company. Mr. Croskey received a Bachelor of Science degree in Aeronautical / Astronautical EngineeringTerex Corporation. He graduated from The OhioMichigan State University with a B.S. in Mechanical Engineering, and an MBA from Wake Forest University’s Babcockthe Kellogg Graduate School of Management at Northwestern University with a Master of Management. Mr. Beck also holds an M.S. degree in Applied Statistics from Oakland University.

Andrew J. FoersterThomas A. Caneris (age 59)58) joined the Company as its ExecutiveSenior Vice President, Human Resources and Chief Technology OfficerGeneral Counsel and Secretary in March 2015. From 2010 to 2015, Mr. Foerster served as Residential and Wiring Devices Division Engineering Director at Eaton Corporation.August 2019. Prior to joining Eaton,the Company, Mr. Foerster wasCaneris served as Senior Vice President Human Resources, General Counsel & Secretary of Technology Innovations at Masco, and President and CEOPharMerica Corporation, a pharmacy services provider from August 2007 to April 2019. Mr. Caneris received his J.D. from the University of Piller Inc. Prior to Piller, Mr. Foerster led the Lighting Controls business at Schneider Electric (Square D Company) and held various marketing and engineering positions with Schneider Electric and General Electric. Mr. Foerster began his career as a nuclear submarine officer in the U.S. Navy. He is a graduate (BSEE)Cincinnati College of the US Naval Academy, and received an MBA from Marymount University and an MSEE from George Mason University. Mr. Foerster is a licensed Professional Engineer.Law.

James E. Galeese (age 61)63) joined the Company as its Executive Vice President and Chief Financial Officer in June 2017. Mr. Galeese, from 2014 to June 2017, served as Vice President, Chief Financial Officer, and as a Director of privately held Universal Trailer Holding Corporation (manufacturer of trailers for the hauling requirements of businesses and individuals). He was with Philips Electronics NV from 1998 to 2014 as Senior Vice President and Chief Financial Officer for its North American Lighting business and its Electronics business. Prior to that Mr. Galeese served in the financial Controllership organization of Square D Company / Schneider Electric. He graduated from Miami University with a degree in Business Administration and obtained an MBA from Xavier University.

Howard E. JaplonMichael A. Prachar (age 66)51) joined the Company in June 2019 as its Executive Vice President Human Resources and General Counselof Lighting Products. He was promoted to the Company’s Chief Marketing Officer in March 2017 and was appointed Secretary of the Company in April 2017.January 2020. Prior to joining the Company, Mr. JaplonPrachar served as Vice President, General Counsel & Secretary of ACE Hardware Corporationin various marketing leadership positions with Honeywell from May 20132018 to March 2017. Prior thereto he served as Vice President and General Counsel of RG Steel,2019; Milacron LLC from 2011 to January 2013 and as Sr. Vice President and General Counsel of Schneider Electric Americas2017; Rexnord Corporation from 2003 to 2011. Mr. Japlon received a Bachelor of Arts degree in Economics from Fordham University and a J.D. from the University of Illinois College of Law.

Crawford C. Lipsey (age 62) has served as Interim President and Chief Operating Officer of the Company since April 23, 2018. Mr. Lipsey currently serves as a non-paid staff member and representative of “Dignity Revolution”, a physical and cyber bullying prevention program serving middle school and high school youth. He also serves on several non-profit boards, including as chairman for the Licking County Family YMCA in Ohio. Prior to his non-profit work, Mr. Lipsey served from August 2013 to June 2015 as EVP Corporate Marketing for Revolution Lighting Technologies, Inc. (NASDAQ). He served as president and chief executive officer of Relume Lighting Technologies, a pioneer in LED lighting and controls technology, from May 2011 until its sale in August 2013 to Revolution Lighting. Prior thereto from 20092008 to 2011 Mr. Lipsey invested in and served as Chief Commercial Officer for Inspired Solar Technologies (IST), a manufacturer of advanced solar tracking systems. Immediately prior thereto, Mr. Lipsey servedEmerson Power Transmission Corporation from February 19992000 to December 2009 as Executive Vice President of Acuity Brands Lighting, the largest lighting company in North America with responsibility for several domestic and international business units with total revenues in excess of $500M. Lipsey also served as President and Vice Chairman of the board of Acuity Brands Technology Services. As a thirty-year veteran of the lighting industry, Mr. Lipsey has contributed significantly to the growth of several of the most prominent brands in the lighting industry. He holds a CPIM certification and has managed product development, sales, marketing, brand management and channel development teams. Mr. Lipsey has worked with both venture capital and private equity and has held executive management positions in both public and private companies ranging from entrepreneurial start-ups to large, publicly traded conglomerates. He received a history degree from Presbyterian College and is a graduate of the Harvard Business School Advanced Management Program.2008.

SECURITY OWNERSHIP

The following table sets forth the beneficial ownership of the Company’s Common Shares as of September 18, 201814, 2020 by each person or group known by the Company to beneficially own more than five percent of the outstanding Common Shares, each Director, each Named Executive Officer, and all Directors and Named Executive Officers as a group. Unless otherwise indicated, the holders of all shares shown in the table have sole voting and investment power with respect to such shares. In determining the number and percentage of shares beneficially owned by each person, shares that may be acquired by such person pursuant to stock options within sixty days of September 18, 201814, 2020 are deemed outstanding for purposes of determining the number of outstanding shares for such person and are not deemed outstanding for such purpose for any other shareholder. Unless otherwise indicated below, the address of each beneficial owner is c/o LSI Industries Inc., 10000 Alliance Road, Cincinnati, Ohio 45242.

| Name of Beneficial Owner | Common Shares Beneficially Owned (1) | Percent Beneficially Owned (2) |

Dimensional Fund Advisors LP |

|

|

Palisades West Building One | 1,906,564 | 7.19% |

6300 Bee Cave Road | ||

Austin, TX 78746 | ||

Royce & Associates LLC |

|

|

141 Avenue of the Americas, 9th floor | 1,697,183 | 6.40% |

New York, NY 10019-2578 |

|

|

Chartwell Investment Partners, LLC |

| |

1235 Westlakes Drive - 400 | 1,369,042 | 5.16% |

Berwyn, PA 19312 | ||

| ||

Directors |

|

|

Robert P. Beech | 36,678 | * |

Gary P. Kreider | 38,555 | * |

John K. Morgan | 18,467 | * |

Wilfred T. O'Gara | 49,793 | * |

James P. Sferra | 319,943 | 1.21% |

Robert A. Steele | 26,657 | * |

Dennis W. Wells | 123,229 | * |

| ||

Named Executive Officers |

|

|

Ronald D. Brown | 10,000 | * |

Jeff A. Croskey | 16,340 | * |

Andrew J. Foerster | 35,830 | * |

James E. Galeese | 58,907 | * |

Howard E. Japlon | 23,500 | * |

| ||

12 Directors and NEOs as a Group | 757,899 | 2.86% |

Name of Beneficial Owner | Common Shares Beneficially Owned | Percent Beneficially Owned | ||||||

Royce & Associates, LP 745 Fifth Avenue New York, NY 10151 | 2,095,452 | 8.0 | ||||||

Dimensional Fund Advisors LP Palisades West Building One 6300 Bee Cave Road Austin, TX 78746 | 1,991,612 | 7.6 | ||||||

Kennedy Capital Management, Inc. 10829 Olive Blvd. St. Louis, MO 63141 | 1,618,013 | 6.2 | ||||||

Accretive Capital Management LLC 85 Wall Street Madison, CT 06443 | 1,597,329 | 6.1 | ||||||

Directors | ||||||||

Robert P. Beech | 66,146 | * | ||||||

Ronald D. Brown | 38,368 | * | ||||||

Amy L. Hanson | 26,757 | * | ||||||

Chantel E. Lenard | 2,266 | * | ||||||

John K. Morgan | 57,935 | * | ||||||

Wilfred T. O'Gara (1) | 110,261 | * | ||||||

Named Executive Officers | ||||||||

James A. Clark | 45,326 | * | ||||||

James E. Galeese (2) | 226,444 | * | ||||||

Thomas A. Caneris (4) | 66,102 | * | ||||||

Michael C. Beck (3) | 57,275 | * | ||||||

Jeffery S. Bastian (5) | 154,709 | * | ||||||

Directors and NEOs as a Group (6) | 851,589 | 3.2 | ||||||

*Less than 1%

(1) Includes 27,000 Common Shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of September 14, 2020.

(2) Includes 150,735 Common Shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of September 14, 2020.

(3) Includes 23,511 Common Shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of September 14, 2020.

(4) Includes 24,468 Common Shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of September 14, 2020.

(5) Includes 117,539 Common Shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of September 14, 2020.

(6) Includes 343,253 Common Shares which may be acquired upon the exercise of stock options which have vested or will vest within 60 days of September 14, 2020.

Delinquent Section 16(a) Beneficial Ownership Reporting ComplianceReports

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers, Directors, and persons who own more than ten percent of the Company’s Common Shares to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Such persons are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file within two days of a transaction in shares of the Company. Based solely upon its review of copies of such forms received by it, and upon written representations from certain reporting persons that no Form 5 was required for those persons, the Company believes that during fiscal 20182020 all filing requirements were met except thatwith the exception of two late Form 4s for Mr. Sferra filed a Form 4 report onJeffery S. Bastian, reporting 27,618 stock options and 6,778 restricted stock units granted by the Company in August 31, 2017 for an August 17, 2017 distribution from the Company’s Nonqualified Deferred Compensation Plan, and except that Mr. Lipsey filed a Form 4 report on June 15, 2018 for a May 30, 2018 purchase of shares.2019.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis section reviews the Company’s compensation philosophy and executive compensation and arrangements for fiscal 20182020 that apply to the Company’s current Named Executive Officers (“NEOs”): Dennis W. Wells, Ronald D. Brown, James E. Galeese, Jeff A. Croskey, Howard E. Japlon and Andrew J. Foerster. It

Name | Title |

James A. Clark | Chief Executive Officer |

James E. Galeese | Chief Financial Officer |

Thomas A. Caneris | SVP, HR and General Counsel |

Michael C. Beck | SVP, Operations |

Jeffery S. Bastian | VP, Chief Accounting Officer |

This section should be read in conjunction with the Summary Compensation Table, the other compensation related tables, and their accompanying narratives and footnotes. As noted throughout this section of the Proxy Statement, Mr. Wells’ employment with the Company ended on April 23, 2018.

Business Transformation

In April 2018, the Board of Directors commenced the search for a new Chief Executive Officer to drive an increased strategic emphasis on product innovation and revenue growth. Effective April 23, 2018, the Board of Directors notified Dennis W. Wells of the termination of his employment. The Board appointed Ronald D. Brown as Interim Chief Executive Officer at that time to replace Mr. Wells. Mr. Wells served as CEO of the Company from October 2014 until April 23, 2018. The Board also appointed Crawford Lipsey as Interim President and Chief Operating Officer. Mr. Brown and Mr. Lipsey served in their interim roles for slightly more than two months during fiscal 2018. Mr. Brown and Mr. Lipsey have over thirty years of combined C-level experience (CEO, COO and CFO) for publicly held and lighting industry companies.

The Company has a rich history of success in several of the key markets that it serves, such as petroleum, automotive and quick serve restaurants. Over time the Company became organized around core products, rather than its customers. The Company recently announced a new organizational structure that will focus on serving key customer markets with the Company’s full package of capabilities in lighting, graphics, digital signage, control and IoT technologies. This new organization eliminated the need for the LSI Lighting President, the Atlas Lighting President and LSI Graphics President positions.

The Company has appointed Mr. Jeff A. Croskey to the newly-created position of Chief Commercial Officer. Mr. Croskey is now responsible for leading all of the Company’s sales and customer service organizations and market channels for all solutions, products, technologies and services. The new organization structure also includes a Chief Marketing Officer, who will be responsible for development of marketing strategies, as well as product development and management, across all served markets based upon customer needs. The primary objective of this more focused organization is to accelerate growth through innovation solutions and customer driven product development. The Company has commenced a search for the CMO position.

Fiscal 20182020 Financial Performance Summary

In fiscal 2018, the Company’s net sales increased 3% to $342 million. The Company incurredsignificantly strengthened its financial position in fiscal 2020 notwithstanding the turmoil brought by the COVID-19 pandemic. The Company generated Adjusted Operating Income of $6.0 million versus $4.0 million in the prior year. Adjusted Net Income was 6.4 million compared to $1.0 million in the prior year. The prior year included a net lossone-time pre-tax favorable adjustment of $19.5$1.2 million for a benefit policy change. Adjusted diluted EPS was $0.12 in fiscal 2020 compared to $0.04 in fiscal 2019. Free cash flow was $47.1 million versus $8.9 million in fiscal 2019. Long-term debt, which had a balance of $40.0 million at the beginning of fiscal 2020, was completely eliminated in fiscal 2020, with the company exiting the fiscal year primarily due to a non-cash goodwill impairment charge of $28with $3.5 million cash. Working Capital decreased $12.4 million and a $3.1 million charge relatedReturn on Net Assets (RONA) improved to the exit of Mr. Wells. After adjusting for one time charges, adjusted operating income for fiscal 2018 was $ 9.6 million, an increase of 33% from fiscal 2017 adjusted operating income.4.1%.

Executive Compensation Philosophy and Design

The Company’s executive compensation program is designed to drive a pay-for-performance culture. The program rewardsstrives to align corporate performance with executive pay, delivering competitive total compensation upon the achievement of the Company’s performance objectives. The achievement of those objectives in turn will create long-term shareholder value. The executive compensation program is also designed to attract, retain and motivate leaders who will focus on the creation of long-term shareholder value. The Company’s pay-for-performance philosophy for the executive compensation program employs a mix of compensation elements - base salary, short-term incentives and long-term incentives - to link executive compensation to Company performance and to clearly align executive interests with shareholder interests.

Responsiveness to 2019 Say-on-Pay Vote

At the 2019 Annual Meeting of Shareholders, approximately 94 percent of the votes cast were in favor of the advisory vote to approve executive compensation. We believe that these vote results, together with feedback received during the Company’s ongoing shareholder engagement, reflect that shareholders are pleased with the structure of the Company’s compensation programs put into place by the Compensation Committee for fiscal year 2019. The Compensation Committee considered this support when reviewing compensation for fiscal year 2020 and made certain changes to the design and structure of the Company’s executive compensation program. Specifically, the Compensation Committee introduced a new long term incentive plan for fiscal 2020 including three equity-based components: stock options, performance share units (“PSUs”) and restricted stock units (“RSUs”). The award of PSUs was intended to create long-term performance alignment for the executive team based on achieving critical operating performance results based on three-year goals related to return on net assets (“RONA”) and earnings before interest, taxes, depreciation and amortization (“EBITDA”) over a three-year performance cycle. The fiscal 2020 PSU awards may cliff vest on the third anniversary grant date if specified three-year RONA and EBITDA objectives are achieved.

With respect to fiscal year 2021 incentive compensation, the Compensation Committee continued its focus on aligning the Company’s executive compensation program with shareholder value creation and continued to use PSUs as a meaningful component of executive compensation.

Compensation Committee Oversight of Executive Compensation Program

The Compensation Committee oversees the Company’s executive compensation philosophy and the design and implementation of its executive compensation program. The Committee reviews and approves, or recommends that the Board of Directors approve, all elements of the Company’s executive compensation program. Any new executive compensation plan or program must be approved by the Board based on the recommendation of the Compensation Committee. The Committee reviews and recommendssets the compensation of the Chief Executive Officer (“CEO”), and the independent Directors, acting as a group, approve the amounts to be awarded to the CEO..

The CEO annually reviews the performance of the other NEOs. After considering the CEO’s assessment and recommendation,recommendations, the Compensation Committee determines and approves the compensation of the other NEOs. The Compensation Committee has absolute discretion to approve the recommendations of the CEO or to make adjustments as the Committee deems appropriate. The CEO and other executive officers from time to time work with the Committee to gather and compile data needed for benchmarking purposes or for other analysis conducted by the CompensationCommittee or Committee’s independent compensation consulting firm, Frederic W. Cook & Co., Inc. (“FW Cook”).

The Compensation Committee retained FW Cook in March 2017 to provide advice on executive compensation matters, including the types and levels of executive compensation and the competitiveness of the Company’s executive compensation program relative to competitors for executive talent. FW Cook reports directly to the Committee and interacts with management at the Committee’s direction. The Committee and its chairperson have regular opportunities to meet with FW Cook in executive session without management present. The Committee considered the independence of FW Cook in light of current SEC rules and NASDAQ listing standards and concluded that no conflict of interest exists that would prevent FW Cook from independently advising the Committee.

Results of 2017 Say-on-Pay Vote

At the 2017 Annual Meeting, the Company conducted an advisory vote on the compensation of its NEOs, commonly referred to as a say-on-pay vote. The Company’s shareholders supported the compensation of the NEOs, with over 88% of votes cast in favor of our 2017 say-on-pay resolution. The Compensation Committee considered this high level of shareholder support when reviewing compensation for fiscal 2018, and did not make any significant structural or design changes to the executive compensation program, except as otherwise set forth herein. The Committee concluded that the Company’s executive compensation program should continue to emphasize the retention, pay-for-performance and long-term shareholder alignment objectives of the Company.

Compensation Committee Evaluation of Executive Compensation Philosophy and Design

The Compensation Committee evaluates and monitors the Company’s executive compensation philosophy and the design of its executive compensation program to assure the Company’s continued ability to attract, retain and motivate leaders who will focus on the creation of long-term shareholder value. The Committee believes that a competitive pay-for-performance executive compensation program employing a mix of compensation elements – base salary, short-term incentives and long-term incentives – links executive compensation to Company performance and clearly aligns executive interests with shareholder interests.

The Compensation Committee reviews competitive market data for comparable executive level positions as a point of reference in its executive compensation decisions. The Committee also reviews the Company’s financial performance, individual NEO performance, and the Company’s competitive environment. The Committee also considers compensation information disclosed by a peer group of companies and industry reference companies with which the Company competes for business and executive talent. The Committee also considers information derived from published survey data that compares the elements of each NEO’s target total direct compensation to the market information for executives with similar roles. FW Cook compiles this information for the Committee and adjusts the published survey data to reflect the Company’s revenue size in relation to the survey participants to more accurately reflect the scope of responsibility for each NEO.

The Compensation Committee, with input from FW Cook, selected a newcontinued to use the same peer group for fiscal 2018.that was used in the prior year. The peer companies were selected primarily based upon the following criteria: (i) similar business operations/industry/competitors for investor capital, (ii) sales and market capitalization between approximately 1/3 and 3 to 4 times the Company’s sales and market capitalization, and (iii) competitors for executive talent.

For fiscal 20182020 compensation purposes, our peer group consisted of 1817 companies. No changes were made to the peer group for fiscal 2019, except that during fiscal 2018 Handy & Harman Ltd. was acquired and is no longer a publicly-held company.

| ||

AAON Inc. | CTS Corporation | Key Tronic Corporation |

Ameresco, Inc. | Daktronics, Inc. | Napco Security Technologies, Inc. |

Broadwind Energy Inc. | Eastern Company | PGT Innovations, Inc. |

CECO Environmental Corp. | Encore Wire Corporation | Powell Industries, Inc. |

Continental Materials Corp. | Gorman-Rupp Company | Revolution Lighting Technologies, Inc. |

CPI Aerostructures, Inc. |

| Trex Company Inc. |

Practices Implemented to serve Shareholder Long-term Interests

The following tables summarize certain executive compensation governance practices that the Committee believes will drive financial performance and serve long-term shareholder interests.

Practices the Company Follows | |

| A significant portion of executive compensation is at-risk and tied to the achievement of various performance objectives that are disclosed to |

| The Company generally considers NEO salaries as part of its annual performance review process in an effort to be responsive to industry |

Balances short-term and long-term incentives | The Company’s incentive programs provide an appropriate balance of annual and longer-term incentives, with long term incentive compensation comprising a significant percentage of target total compensation. |

Uses multiple performance metrics | The Company mitigates the risk of the undue influence of a single performance metric by utilizing multiple performance metrics for |

Caps award payouts | Cash incentive payouts under the short-term incentive plan are capped at |

| Target compensation for NEOs is set after consideration of market data at peer group companies, industry reference companies and other market data. |

| The Company’s equity grants are subject to a one year holding period upon exercise. The Company also maintains stock ownership guidelines for its directors and NEOs. |

Conducts a risk assessment | The Compensation Committee annually conducts a compensation risk assessment to determine whether the compensation program, or elements thereof, create risks that are reasonably likely to have a material adverse effect on the Company. |

Acts through an independent Compensation Committee | The Compensation Committee is comprised entirely of independent directors and has retained an independent compensation consulting firm. |

Practices the Company Prohibits | |

No excise tax gross-up payments | The Company does not enter into any new contractual agreements that include excise tax gross-up payments. |

No | The Company has never |

No pledging or hedging of shares | The Company’s insider trading policy restricts Board members and executive officers from entering into hedging transactions with respect to the Company’s securities and from holding the Company’s securities in margin accounts or otherwise pledging such securities as collateral for loans. |

No special perquisites to executives | The Company does not provide executives with benefit programs or perquisites that are not generally made available to all Company employees, except in limited circumstances. |

Elements of Executive Compensation

As more fully described below, the Company’s executive compensation program consists of four elements: a competitive base salary benchmarked against a peer group of companies as well as industry reference companies and other relevant market data; a short-term cash incentive plan tied to the Company’s annual financial performance results and the NEO’s individual performance; a long-term incentive plan utilizing equity in various forms; and customary benefits. The Company’s executive compensation program is designed to reward executives with above-market pay for results which exceed the Company’s target performance goals and objectives. The following table summarizes the elements of the NEO compensation program.

Element | Form of Compensation | Purpose |

Base Salary | Cash | Provides competitive, fixed compensation to attract and retain superior executive talent. |

Short-Term Incentive Plan | Cash | Provides a direct financial incentive to achieve annual Company and individual performance objectives. |

Long-Term Incentive Plan |

| Encourages the executive team to earn, build and maintain a long-term equity ownership position through Company and individual performance so that executive interests are aligned with shareholder interests. A portion of the awards are earned only if certain performance objectives are achieved. |

Health, Retirement and Other Benefits |

| Benefit plans are part of a broad-based employee benefits program; the nonqualified deferred compensation plan |

The Compensation Committee reviews the risk profile of the elements of the Company’s executive compensation program, including the performance metrics and objectives used in connection with incentive awards. The Committee considers the risks ana NEO might be incentivized to take with respect to such elements, metrics and objectives. When establishing the mix among these elements, the Committee carefully calibrates the elements to avoid encouraging excessive risk taking. The Company’s executive compensation program is balanced between annual and long-term incentive compensation to ensure alignment with short-term objectives and with the Company’s long-term business plan and shareholder interests. The Committee also determines that the overall mix of equity-based awards has been allocated to promote an appropriate combination of retention and incentive objectivesobjectives.

The Committee believes that the Company’s executive compensation program does not encourage the NEOs to engage in business activities or other behavior that might threaten the value of the Company or shareholder interests. The Committee regularly monitors and evaluates the mix of compensation, especially equity compensation, awarded to the NEOs, and the extent to which such compensation aligns NEO interests with shareholder interests. In connection with this practice, the Committee has, from time to time, reconsidered the structure of the Company’s executive compensation program and the relative weighting of various elements of pay. Please refer to the discussion in the “Compensation Mix” section.

Base Salary

The Compensation Committee reviews each NEO’s base salary, the scope of each NEO’s level of responsibility and potential, as well as base salary levels offered by competitors and the overall marketplace. Base salary is set at a level that is market competitive in order to attract and retain highly qualified leaders. Base salary reflects the NEO’s scope of responsibility, breadth of experience, ability to contribute to, and impact corporate performance, and a demonstrated track record of individual performance. The Committee has engaged FW Cook to assist in benchmarking each NEO’s base salary and total direct compensation opportunity and each element of executive compensation. The assessment also factors in peer group and industry reference company data and other relevant market data.

In general, the Company seeks to provide target compensation opportunities that are competitive with its peer group companies and other compensation data sources, as provided by FW Cook. There may be instances which indicate the need to pay above target level compensation and the Company is prepared to do so within reasonable limits. The Committee applies a collective, subjective evaluation of the above factors to determine the annual base salary level of each NEO in light of the Company’s performance and such NEO’s individual performance. The Committee does not utilize a particular objective formula as a means of establishing annual base salary levels.

The Compensation Committee did not increasemade the following increases to NEO base salaries for fiscal 2018, electing to maintainyear 2020: Mr. Clark: $16,500 (3.3%); Mr. Galeese: $25,000 (7.8%); Mr. Bastian: $4,800 (2%); and Mr. Beck: $6,500 (2%). Because Mr. Caneris’ began employment with the NEOCompany on August 5, 2019, which was early in the fiscal year, he did not receive an increase in base salaries at the levels that were in effect during fiscal 2017 in light of fiscal 2017 results. Effective September 1, 2018 for fiscal 2019, the base salary of Mr. Galeese was increased to $345,000 from an annualized rate of $320,000; the base salary of Mr. Croskey was increased to $335,000 from an annualized rate of $289,000 in consideration of his increased responsibilities; the base salary of Mr. Japlon was increased to $329,600 from an annualized rate of $320,000; and the base salary of Mr. Foerster remained at $296,000.salary.

Short-Term Incentive Plan

The Company’s annual short-term incentive plan (the “STIP”) provides for the payment of an annual cash incentive and motivates the NEOs to achieve and exceed the Company’s annual operating plan objectives. The Company’s STIP has used net sales and operating income as the Company financial performance metrics for the past several years. The achievement of the Company’s net sales and operating income performance objectives are directly relevant and correlated to growth in shareholder value. These metrics are straightforward and relatively easy to understand, which is critical given that the vast majority of the Company’s employees at all levels of the organization participate in the STIP.

In August 2017,2019, the Compensation Committee adopted the Fiscal Year 20182020 Short Term Incentive Plan for NEOs (the “FY18“FY20 STIP”). The FY18With respect to short term compensation, the STIP provideswas redesigned for 2020 to reduce the potential maximum payout to 160% from 200%. Additionally, the FY19 performance metric of Operating Income was changed to Adjusted EBITDA, because the Committee believed that the measure more accurately reflects operating performance because it excludes amortization of intangibles, which can be confusing and unclear. Secondly, EBITDA is a cash incentive award tohighly referenced and preferred performance metric with the Company’s NEOs based on the achievement of the Company’s fiscal 2018 performance objectives. The performance metrics for fiscal year 2018 are netshareholder and analyst community. Net sales and operating income, each weighted at 50%. The incentive award opportunity stated as a percentage of base salary is identifiedremained in the following table at indicated levels of achievement of the fiscal 2018 performance objectives.FY20 STIP as that measure remains aligned with incentivizing growth in shareholder value creation.

Executive | Threshold Achievement | Target Achievement | Maximum Achievement | |||||||||

CEO | 50% | 100% | 200% | |||||||||

Other NEOs | 20% | 40% | 80% | |||||||||

The incentive award opportunity for fiscal 2018 reflects an increase for the CEO in the incentive payout percentage to 50% for threshold plan achievementFY20 STIP places much greater emphasis on EBITDA over Net Sales, with EBITDA weighted 80% and to 100% for target plan achievement (the prior fiscal year 2017 plan payout was 25% for threshold performance and 90% for target plan achievement). The maximum incentive payouts remain unchanged from fiscal 2017 at 200% of target for all NEOs. Based on the financial performancenet sales weighted 20% of the Company, the Compensation Committee approved FY18 STIP cash incentive awards to the NEOs for fiscal year 2018 of 15.76% of base salary as set forth in the Bonus column in the Summary Compensation Table based on the achievement of the Company’s fiscal 2018 performance objectives as reflected in the following table.

Metric | FY18 Plan | FY18 Actual | % Plan (1) | Target Bonus | % Bonus (2) | Metric Weight | % Payout | |||||||||||||||||||||

Net Sales | $382,595 | $342,023 | 89.40% | 40.00% | 31.52% | 50.00% | 15.76% | |||||||||||||||||||||

Operating Income | $17,973 | $9,612 | 53.46% | 40.00% | 0% | 50.00% | 0% | |||||||||||||||||||||

FY18 STIP Payout % | 15.76% | |||||||||||||||||||||||||||

|

|

|

|

In August 2018, the Compensation Committee adopted the Fiscal Year 2019 Short Term Incentive Plan for NEOs (the “FY19 STIP”). The FY19 STIP continues the use of net sales and operating income as the performance metrics and continues the 50% weighting for each metric.total incentive. A notable change in the FY19FY20 STIP is that payment of any FY19FY20 STIP award will bewas subject to the Company achieving a threshold level of operating incomeadjusted EBITDA that is equal to the amount ofwas 6.5% above the Company’s fiscal 2018 operating income. In addition,2019 adjusted EBITDA. The rigorous targets under the incentive award opportunity for eachFY20 STIP were set at very challenging levels and the Company was unable to achieve the plan threshold in light of the Company’s Chief Financial Officer and Chief Commercial Officer has been increased as reflectedchallenges related to the COVID-19 pandemic. As a result, no payments were awarded with respect to the FY20 STIP.

FY20 STIP Performance Metrics | ||||

Performance Metric | Threshold Achievement | Target Achievement | Maximum Achievement | Actual Results |

Net Sales | $329 Million | $339.626 Million | $345.295 Million | $305.6 Million |

Adjusted EBITDA | $15.175 Million | $17 Million | $23 Million | $15.038 Million |

2020 Potential Payout Levels

Executive | Threshold Achievement (% of base salary) | Target Achievement (% of base salary) | Maximum Achievement (% of base salary) |

James A. Clark | 40 | 80 | 160 |

James E. Galeese | 25 | 50 | 100 |

Thomas A. Caneris | 25 | 50 | 100 |

Michael C. Beck | 25 | 50 | 100 |

Jeffery S. Bastian | 20 | 40 | 80 |

The Compensation Committee considered the significant improvement in the Company’s financial performance from fiscal year 2019 to fiscal year 2020 despite the impact of the COVID-19 pandemic and decided that it was in the best interests of the Company to make a partial discretionary bonus to the NEOs and certain other employees. Discretionary payments to the NEOs are set forth in the table below. Financial performance results taken into consideration by the Committee included: increases to Operating and Net Income, EBITDA, EPS, Cash flow and RONA. The gross margin rate increased 130 basis points and operating costs decreased by $3.4 million. These performance results were achieved by transitioning sales to a less commoditized, higher-value mix of business, reduction in the Company’s manufacturing footprint, which served to increase capacity utilization, lower costs, and reduce the Company’s asset base. Two manufacturing facilities were vacated and sold, with production relocated to other facilities, contributing to cash generation of $47 million in fiscal year 2020. The cash was utilized to eliminate $40 million of long-term debt in fiscal year 2020. The business also accelerated the development and launch of new products, contributing to the improved business performance. Additionally, the Compensation Committee recognized the prompt and proactive actions taken by the management team to protect employee health and preserve financial results in response to the COVID-19 pandemic The Committee determined that these performance results in light of the adverse effects related to the COVID-19 pandemic warranted the following table.discretionary awards:

Executive | Threshold Achievement | Target Achievement | Maximum Achievement |

CEO | 50% | 100% | 200% |

CFO & CCO | 25% | 50% | 100% |

Other NEOs | 20% | 40% | 80% |

Named Executive Officer | Discretionary Award | |||

James A. Clark, CEO | $ | 271,920 | ||

James E. Galeese, EVP & CFO | $ | 100,000 | ||

Thomas A. Caneris, SVP Human Resources & General Counsel | $ | 95,000 | ||

Michael C. Beck, SVP Operations | $ | 50,000 | ||

Jeffery S. Bastian, VP & Chief Accounting Officer | $ | 29,670 | ||

Long-Term Incentive Plan (LTIP)

The Company’s long-term incentive plan (the “LTIP”) provides for the award of stock options, performance share units, restricted stock, restricted stock units, and other forms of equityperformance share units under the terms of the Company’s 2012 Stock Incentive2019 Omnibus Award Plan. The LTIP rewards executives for achieving the company’s long-term performance goals which in turn will create long-term shareholder value. The grant of equity basedequity-based compensation provides a strong longer-term alignment of NEO interests with shareholder interests. The Company has adopted stock ownership and retention guidelines for the executive team to reinforce such alignment.

In connection with the LTIP equity awards granted to the NEOs, the Compensation Committee generally exercises broad discretion to achieve an appropriate balance between retention and incentive objectives. The Committee attempts to reward the NEOs with LTIP equity awards in an amount that would be significant in relation to the other annual compensation paid to the NEOs, and in the Committee’s judgment, reasonable and appropriate after considering the NEO’s total compensation in relation to that of the most senior executives of companies in similar industries identified in reports prepared for the Committee. The size of the award is not determined by application of any formula, but rather reflects the Committee’s desire to encourage and reward high levels of performance.